Our popular Stock Market Challenge returned on 28 January 2026 to provide the opportunity for Queen’s students from any course background to gain real-world experience of analysing markets and making investments.

Stock Market Challenge is a fast-moving and exciting stock market simulation game called Finance Lab Pro owned by SolutionSim, who were our hosts for the evening at the Queen’s Computer Science Building.

Set in a fictitious world financial market this competitive game gives participants the opportunity to experience analysing the market and making investments.

The best part is you do not have to be studying a finance related subject or have any specialist knowledge of finance!

It’s a game of strategic thinking and pressured decision so the students got to demonstrate many of the skills necessary for business life, including, team-working, problem-solving and critical thinking.

Students taking part enjoyed some pizza and networking with the Employers also taking part on the night, with prizes including insight opportunities with the participating Employers. This Careers programme is also Future-Ready Award accredited through the Combined Route so students who took part can apply for this award before they graduate.

We want to give our thanks to the Employers that took part, Deloitte, Kainos, First Derivative, Funds Axis and Grant Thornton and thanks also to our delivery partner Liam Barnes at SolutionSim, and to everyone who took part and made it the success that it was!

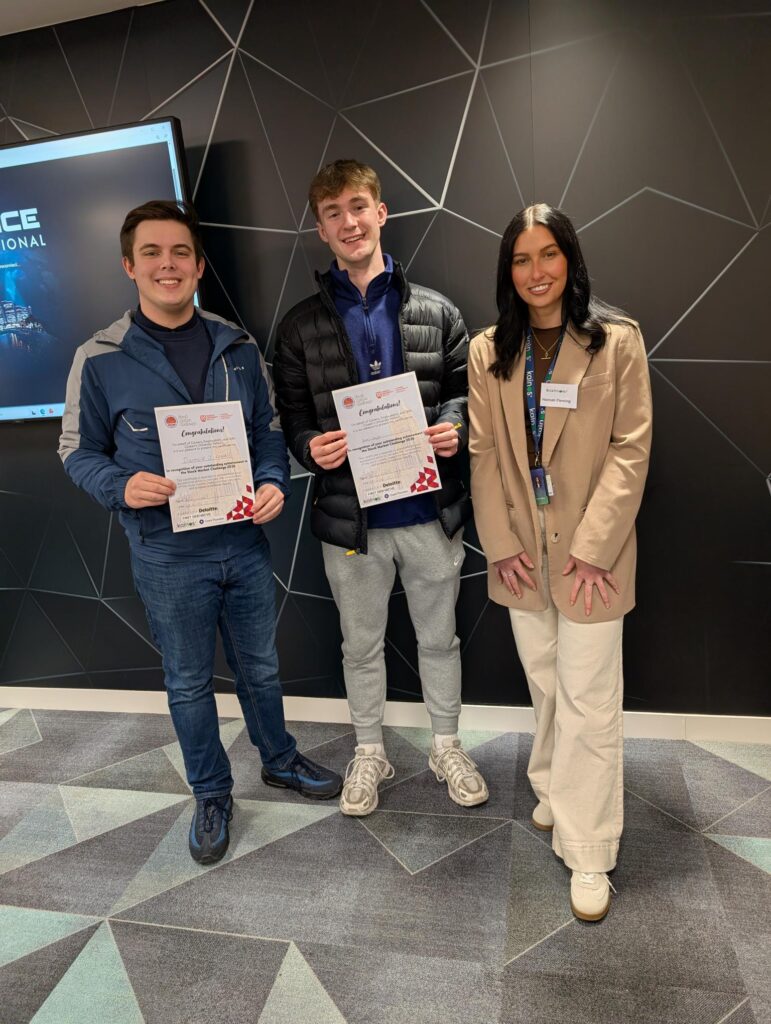

Congratulations to our Stock Market Challenge 2026 winner Cadhan Nelis, you played a great game! And congratulations also to the runners up and everyone who took part in the popular competition.

List of Stock Market Challenge 2026 Winners and Runners Up:

1st Place – Cadhan Nelis, Queen’s Computer Science ,with William Gordon from Deloitte.

2nd place – Diarmuid Lawell, Queen’s PPE, and Robin Smyth, Queen’s PPE, with Hannah Flemming from Kainos.

3rd place – Kyan Cassidy, Queen’s Finance, and Oliver Billing, Queen’s Applied Maths – with Joanne Marron, Aoibhin McKinney from First Derivative.

4th place – Alex Dunne, Queen’s Aerospace Engineering and Colm Daly, Queen’s Aerospace Engineering – with Hannah McCloskey, Phoebe Callista from Funds Axis.

5th place -Yash Somaiya, Queen’s Aerospace Engineering, and Neha Hendre, Queen’s Business Management – with Conor Gallagher, Jason Smyth from Grant Thornton.

6th place – Rosaleen Grant, Queen’s Finance and Trading, and Harry Jackson, Queen’s English student.