Student Blog by Bea Holland, BA in French and Portuguese

Blackbullion is an amazing educational tool, full of financial advice. I spent some time going through their posts and pathways and you need to too!

As a Queen’s student you get Blackbullion for FREE by logging in with your Queen’s email.

1. Budgeting Tips

Budgeting can be really hard to get to grips with, but Blackbullion has a whole section dedicated to budgeting tips and a step-by-step guide to creating your own budget so I could make a budget that works for me!

Its budget calculator means you can ditch the pen and paper and have an online resource to help.

2. Debt Repayment

Debt is a huge worry for students but the Blackbullion Debt section really easily breaks down repayment, including the different methods such as the snowball vs avalanche method.

3. Opening a Bank Account

Opening a bank account can be very confusing, especially for international students.

Luckily Blackbullion has a whole section just for International Students, and a specific page on how to open a bank account as an International Student including the different options to consider.

4. Student Loan Repayment

Student Loan Repayment can be a really scary thought, so Blackbullion’s Student Loan Repayment Calculator is such a handy tool to help see what the rates are currently and how that can and will affect students.

5. Funding

One of my favourite things about Blackbullion is its funding database. Log in with your Queen’s email and you can get access to a list of all the grants, bursaries and scholarships you’re eligible for. They also have a great guide about Hardship funding and how to apply for it.

6. Buy Now Pay Later Schemes

Buy Now Pay Later schemes are almost unavoidable but do you know what they really are and the risks? Learn all about what these schemes really mean for you and how to make safe financial choices.

7. Taxes

We all know what taxes are but we’re never really taught about: how they work, what they mean for our salaries and how to pay them.

Blackbullion has a brilliant learning pathway all about tax so you can fill any gaps in your knowledge and feel more secure about the future.

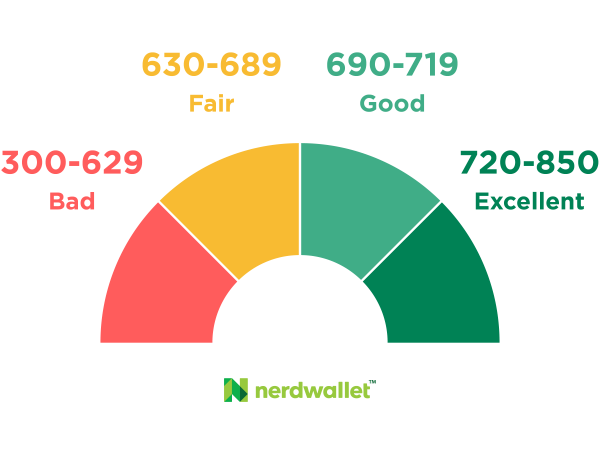

8. Credit Scores

We all hear about credit scores but do you actually know what they are, how they work and what they affect? Use Blackbullion’s credit pathway to answer all those questions and more!

9. Savings

Learn how to save money from personal savings to emergency funds and take part in their 21-day money-saving challenge!

Register to Blackbullion for free here